[Q&A] Bond

Q: tell me about bond.

A: bond is a debt security that provides fixed/predictable cash inflows for its investors in a given period. Key elements of a bond include: par value/face value; coupon rate; yield; maturity; price/value; credit rating.

Q: what's the difference between yield and rate of return?

A: the yield on a bond is the internal rate of return or "yield to maturity" or "promised yield". The rate of return on a bond is the realized cash flow to the bondholder, or "holding period return". If the holder sells the bond before maturity, yield and rate of return may not be same.

Q: how to value a bond?

A: the value of a bond is the sum of the PV of its cash inflows. To be specific:

V=C1/(1+r)+C2/[(1+r)^2]+...+(Cn+P)/[(1+r)^n]

Therefore we can see, other things equal:

- the higher coupon rate, the higher bond value.

- the higher bond yield, the lower bond value.

- the longer maturity, the higher bond value.

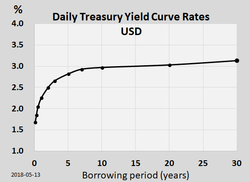

Q: explain the bond yield curve.

A: yield curve demonstrates the relationship between maturity and bond yield. The longer maturity, the higher bond yield. But the curve is convex.

Q: why yield curve invert?

A: yield curve invert means: the long-term bond yield is lower than the short-term bond yield, or the 10yr-2yr interest gap is negative, which is a signal of economic recession. Because when the market is down, investors will sell off stocks and turn to the bond market for long-term investment to avoid risk, which push up the bond price and send the long-term yield rate down. Meanwhile, lower yield rate restricts the interest rate that commercial bank could ask for from loans, therefore more difficult for corporations and families to get loans from banks, and harder to expand production and consumption.

Q: what trading strategy you will apply to deal with the changing yield curve?

A: assume I have a short investment horizon and want to profit from the change in the yield curve, be insensitive to the parallel shift in the curve, but positively sensitive to a flattening/steepening curve. And I will use an immunization strategy.

If the yield curve flattens, the long-term yield gets lower and the short-term yield gets higher, I will long the long-term and short the short-term.

If the yield curve steepens, the long-term yield gets higher and the short-term yield gets lower, I will short the long-term and long the short-term.

And match both the duration and the price of the positions.

Q: tell me more about immunization.

A: It is an investment strategy used to minimize the interest rate risk of bond investment by adjusting the portfolio duration to match the investor's investment time horizon.

When the bond portfolio is immunized, the investor receives a specific rate of return over a given time period regardless of what happens to the interest rate. In other words, the bond is immune to fluctuating interest rate.

If you need to have 50,000 in 5 years for your child's education, you can immunize your portfolio by buying:

(1) one zero-coupon bond with a 5-year maturity

(2) several coupon bonds each with a 5-year duration

(2) several coupon bonds that average a 5-year duration

Q: so what is duration and how to calculate it?

A: duration is the sensitivity of a bond's price to changes in interest rate, measured in years. It is a weighted average of bond's cash flows over its life. And the weighs are the PV of each interest payment as a percentage of the bond's full price.

It is calculated as:

D=t1*PV1/V+T2*PV2/V+...+Tn*PVn/V

If interest rates rise 1%, a bond with a 2-year duration will fall about 2% in value.

Other things equal:

- bond with longer maturity has longer duration.

- bond with lower coupon has longer duration.

- bond that is more sensitive to interest rate has longer duration.

- zero coupon bond has longest duration, which equals to its maturity.

Q: is there any limitations with duration?

A: yes.

(1) Duration is only valid when the change in interest rate is small.

(2) Since it assumes a parallel shift in the yield curve, any steepening/flattening in the curve makes the result less accurate.

(3) Duration assumes the cash flows are known and unchangeable. It does not consider embedded options such as calls and puts.

Q: any other indicators to measure the relationship of interest rate and price sensitivity?

A: convexity. It is calculated as the second derivative of bond price and interest rate (duration is the 1st derivative). It measures the non-linear relationship of bond price to changes in interest rate. Bond with the same duration may have different convexity.

Q: is there a case that, two bonds are issued by the same issuer with the same maturity, coupon, par value, credit, but trading at a different price?

A: yes. Maybe one bond has an embedded option, which is a callable/puttable bond, but the other is not.

Q: tell me about the callable/puttable bond.

A: callable bond means, the bond issuer can redeem/call back the bond at some point before the maturity date. If the interest rate continues to drop, the issuer would pay a relatively high coupon to the buyer. In such a case the issuer would like to call back the bond so that it is no longer committed to paying such a high coupon. The yield calculated up to the callback period is the "yield to call".

puttable bond means the bond buyer/holder can ask for early repayment of the principle. If the interest rate continues climbing (even higher than the coupon rate), the bondholder can ask for early take up to prevent the bond from further devaluation.

to sum up, if the interest rate drops, issuers are more likely to issue a callable bond. If the interest rate rises, investors are more likely to buy a puttable bond.

Q: finally tell me some other bond types.

A: by the issuers, there are government bond, municipal bond, corporate bond, agent bond, international bond;

by bond credits, there are investment grade bond with high credit rating, and high yield bond/junk bond with low credit rating. Investment grade bond has a longer duration because of the lower coupon, therefore more sensitive to interest rate change.

there are also asset-backed securities (ABS) and mortgage-backed securities (MBS).

评论

发表评论