[heard on the street] 20181029-20181104

MACROECONOMY

1. U.S.

1.1 GDP

but the slowdown is looming?

GDP component: consumer spending, net exports, inventories

1.2 labor

personal income: expected to rise 0.3% in Sep compared with Aug.

unemployment:

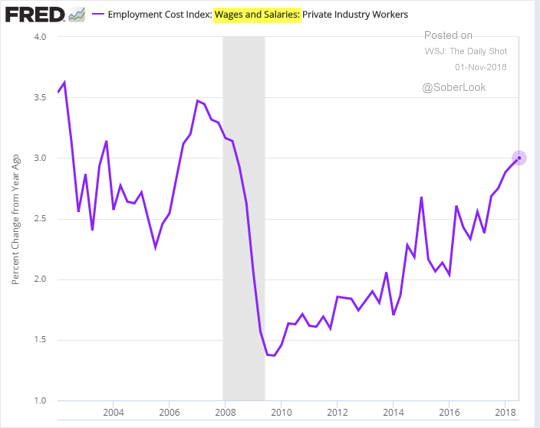

employment cost:

wages: improving pay for workers

1.3 consumption

consumer spending: strong, expected to climb 0.4% in Sep compared with Aug.

personal consumption:

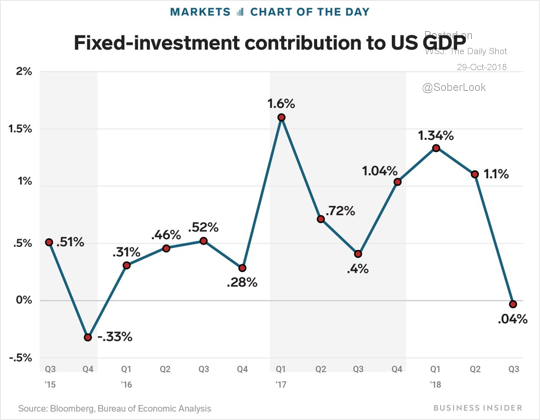

1.4 investment

business investment: slowed

fixed investment's contribution to GDP: decreased

1.5 housing

house price:

ownership:

1.6 price and market sentiment

CPI: lower than expected

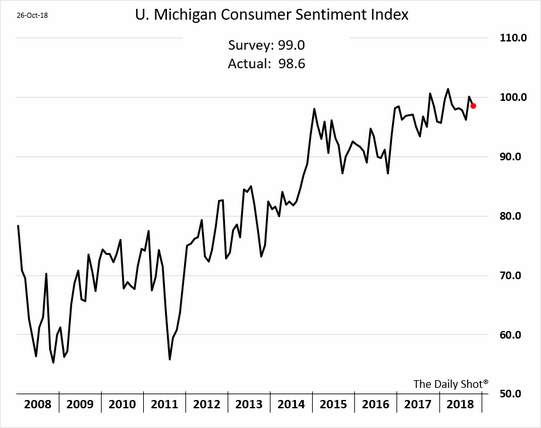

consumer sentiment: high

consumer confidence:

manufacturing: growing divergence

financial condition: tight

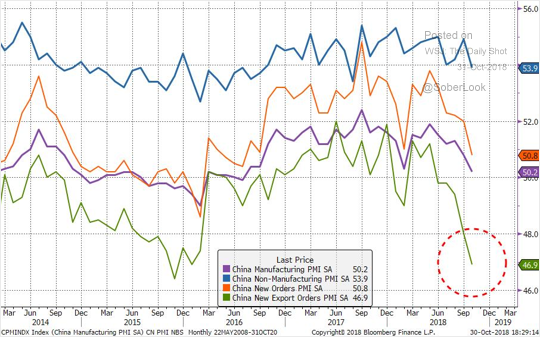

2. China

2.1 industrialindustrial profit: slowed

2.2 trading

export: dominated by domestic private firms

export orders have been soft.

3. investment

fixed asset investment:

2.4 labor

wage tracker:

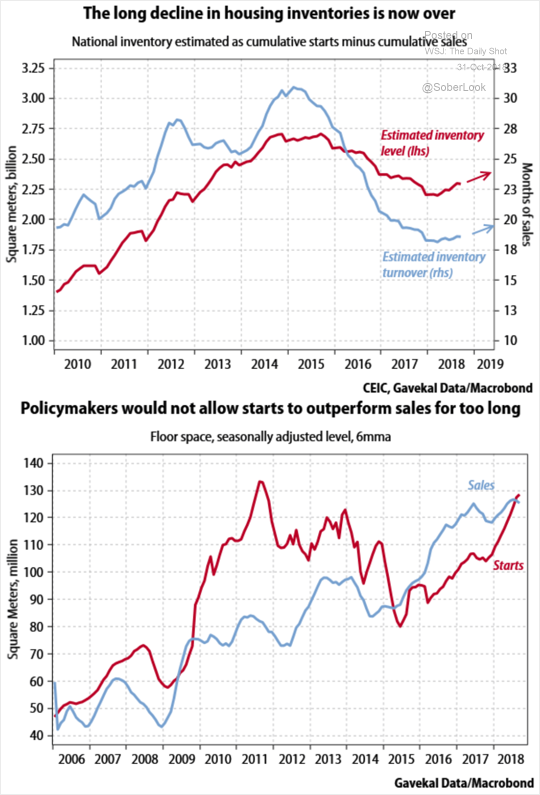

2.5 housing

housing policy

housing inventory

house price

property sales

CURRENCY

USD:

RMB: multiyear low point

China's currency hit its weakest point in nearly two years last week. The yuan’s decline may exacerbate trade tensions—it makes Chinese goods cheaper in the U.S. and U.S. goods more expensive in China.

The yuan is rallying on renewed hopes for a US-China trade deal.

HKD

EM currency: most outperform the S&P 500

bitcoin: pegged to dollar

STOCK

1. U.S.

1.1 OVERVIEW

volatility: huge

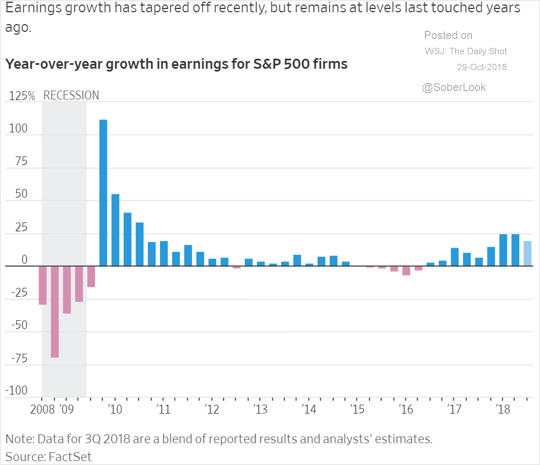

earning growth: remain strong

Let's recap just how bad October was for markets:

- The S&P 500 lost almost $2 trillion for its worst month since September 2011.

- The Dow lost 5.1% for the month, the S&P 6.9%, and the Nasdaq 9.2%. The main drivers? Fears corporate America is closing in on peak earnings, concerns over a trade war with China, and worries about rising interest rates.

- Here's the real kicker: It was the most volatile October in a decade...and October is known for putting equities markets on a roller coaster.

- As for the midterm election...

1.2 DAILY TRACKER

Monday:

Dow shed 245 points, or 1%; swung more than 900 points between high and low.

Nasdaq down 1.6%.

The oct technology sector slump (drop) turned into a stampede Monday.

traders continued to flee the shares that were the strongest performers.

Amazon slumped 6.3%, Netflix fell 5%, boeing ended 6.6% lower

Tuesday:

The Dow Jones Industrial Average rose 431.72 points, or 1.7%, to 24874.64.

The S&P 500 added 1.5%, a day after shedding 0.7% and teetering on the brink of correction territory. The index has tumbled 9.9% through Monday’s close from its recent peak.

The technology-heavy Nasdaq Composite climbed 1.5%.

Wednesday:

The tech-heavy Nasdaq Composite climbed 2%, though it remained down 9.2% for October and posted its worst month since 2008.

The S&P 500 added 1.1% to climb in consecutive sessions for the first time since Sept. 20 but still posted its largest one-month drop in more than seven years, off nearly 7% for October.

The Dow Jones Industrial Average climbed 241 points, or 1%, to 25116, paring its monthly drop to 5.1%, its largest such fall since January 2016.

The blue-chip index finished the month down 5.1%.

Thursday:

Stocks’ streak of outsize moves continued:

The Dow Jones Industrial Average rose 264.98 points, or 1.1%, to 25380.74. The S&P 500 added 28.63 points, or 1.1%, to 2740.37.

The Nasdaq Composite climbed 128.16 points, or 1.8%, to 7434.06, its seventh consecutive move of at least 1% higher or lower.

Apple, which reported better than expected earnings after the close, spooked analysts with slowing iPhone sales. Apple shares sank 6.5%, and index futures moved lower.

Friday: Trade tallk between China and the U.S.

The broad stock-market index shed 17.31 points, or 0.6%, to 2723.06 on Friday, led by the tech sector, which slumped 1.9%.

The tech-heavy Nasdaq Composite posted steeper declines, down 77.06 points, or 1%, to 7356.99.

Apple’s declines put the rest of the tech sector under pressure. Netflix and Intel fell more than 2%; Google parent Alphabet dropped more than 1%; and Facebook shares declined less than 1%.

1.3 BY SECTOR

sector flows:

tech:

Followed Europe, Asia and Latin America began to levy new taxes on tech companies such as FB and Google.

The so-called FANG stocks—Facebook, Amazon.com, Netflix and Alphabet—have lost nearly $430 billion in market value this month. That total would mark the group's largest monthly drop ever going back to Facebook's 2012 initial public offering, according to Dow Jones Market Data.

industrial

consumer/retail

banking

energy

oil production:

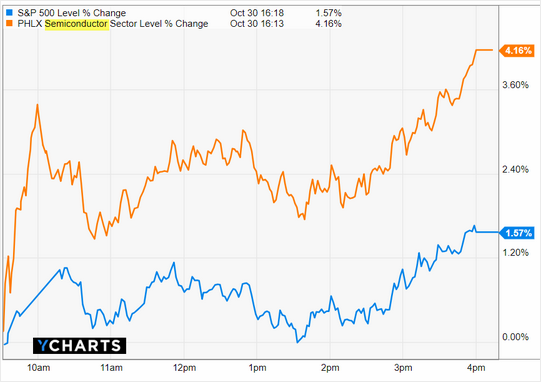

semiconductor: jumped

homebuilder:

new communications service:

real estate:

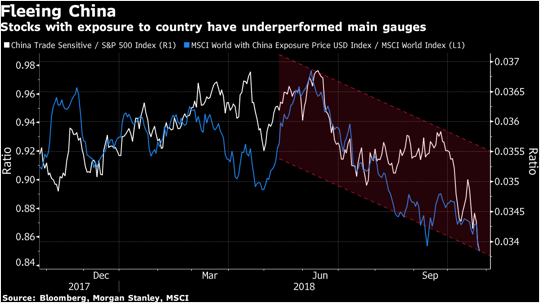

2. China

Trump administration is reportedly prepping tariffs on the remaining $257 billion in Chinese imports not already subject to tariffs.

Shares in Kweichow Moutai, the world’s most valuable liquor company, fell by their daily limit of 10% on Monday on Shanghai's stock market as sales growth took a surprise hit.

RATES

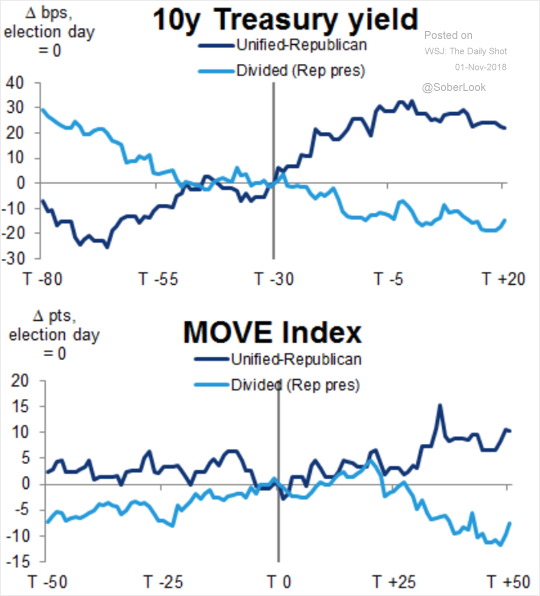

treasury:

LIBOR:

overnight:

The U.S. Treasury Department estimates it will issue more than $1 trillion in debt this year as higher government spending and sluggish tax revenues push the deficit higher.

Federal fund rate

Expectations for gains in the federal-funds rate have risen because of the strong likelihood that the Fed will lift the rate at its December policy meeting.

Last week, the effective federal-funds rate stood at 2.20%, up from 2.18% in the initial days after the Fed in September raised its target range to 2% to 2.25%.

bond

investment grade bond: issuance slowed, remain under pressure

U.S. investment-grade issuance slipped 34% from September, according to Dealogic, while high-yield issuance was down 50% from October 2017. Even before last month’s turbulence, American companies had been raising less money. By the end of September, total investment-grade issuance in 2018 was down 12% compared with the first nine months of last year and high-yield issuance had fallen by almost a third.

corporate bond:

government bond:

The yield on the benchmark 10-year U.S. Treasury note rose to 3.155% from 3.111%. Yields climb as prices fall and have dropped from their Oct. 5 multiyear high with investors seeking safety in Treasurys.

junk bond: yield grow higher

High-yield bonds, until recently a rare bright spot in fixed income, have declined particularly sharply in recent weeks.

CDS Spread

CREDIT

federal debt:

government borrowing:

COMMODITIES

metals:

oil:

gas:

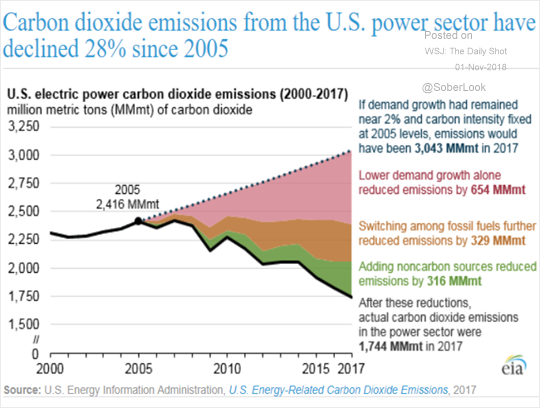

power:

DEALS AND CORPS

The U.K. will introduce a new tax that targets large technology companies, starting in 2020.

IBM:

IBM, founded over a century ago, is making its biggest-ever acquisition with a $33 billion deal for Red Hat. The deal's value is around 29% of IBM's market capitalization and may weigh on earnings in the near-term.

GE:

General Electric slashed it dividend to a token amount and said it would split its struggling Power division into two units, in the first moves to restructure the struggling conglomerate under new CEO Larry Culp.

The moves came after the company reported a net loss of $22.8 billion in the third quarter because of an accounting charge, highlighting the depths of the problems facing the company.

General Electric shares fell after it slashed its dividend and disclosed a federal criminal probe into its accounting. The stock, down 8.8% Tuesday, has lost roughly half its value in the past 12 months and been kicked off the Dow Jones Industrial Average.

FB:

Facebook recorded lower revenue than expected in the third quarter as the social-media giant continues to adjust to slowing growth rates. The social network posted lower revenue than expected and said it is in the early stages of a transformation in its core businesses that will lead to slower growth and higher costs in the short term.

Q3 was a little...less rough:

In the quarter, Facebook reported $1.76 in EPS (earnings per share), up from $1.59 last year and ahead of projections. Revenue came in at $13.73 billion, up 33% annually but just short of forecasts. But the key metric Wall Street's watching? User growth. Monthly active users on FB totaled 2.27 billion, up 10% annually.

IPO:

Biotech IPOs are on track for a near-record year, with offerings that are younger, more highly valued—and, some say, riskier—than any in recent memory. Through mid-October, more than 50 drug developers had raised over $5.5 billion in U.S.-listed IPOs this year, with at least eight more biotechs on deck for 2018.

BB banks:

The U.S. charged two ex-Goldman Sachs bankers and a Malaysian financier in a vast global scheme to launder billions from Malaysia's sovereign wealth fund, 1MDB. It's one of the biggest instances of financial fraud...ever.

Deutsche Bank draws activist investment. An activist hedge fund has taken a 3.1% stake in the German lender, backing its CEO and betting on the beleaguered bank to turn itself around.

Barclays said Chairman John McFarlane will depart in May and named Rothschild executive Nigel Higgins as his successor.

trade talk:

There has been some movement on the US-China trade impasse. It started with this tweet from President Trump on Thursday.

Despite the conversation, the sides remain at somewhat of an impasse. The U.S. wants China to come forward with a specific negotiating agenda before resuming preliminary talks—something China hasn't done.

Highlighting the ongoing tension, the U.S. Justice Department accused Chinese state-owned Fujian Jinhua Integrated Circuit of stealing trade secrets from the largest U.S. memory-chip maker, Micron Technology, in a grand jury indictment unsealed on Thursday.

Market response:

- After-hours trading in the U.S., though, pointed to more turbulence ahead for the beaten-down tech sector. Apple shares tumbled after its disappointing guidance for the current quarter, and Amazon.com, Google parent Alphabet and Netflix—all down by double digits over the past month—followed.

- U.S. companies are ramping up share buybacks again. Some analysts hope that could support share prices pressured by geopolitical and economic uncertainty, but others doubt the pace is sustainable.

- Separately, regulators plan to ease requirements that banks keep billions of dollars of cash on hand to pay short-term bills. What banks will do with the extra cash is an open question.

评论

发表评论